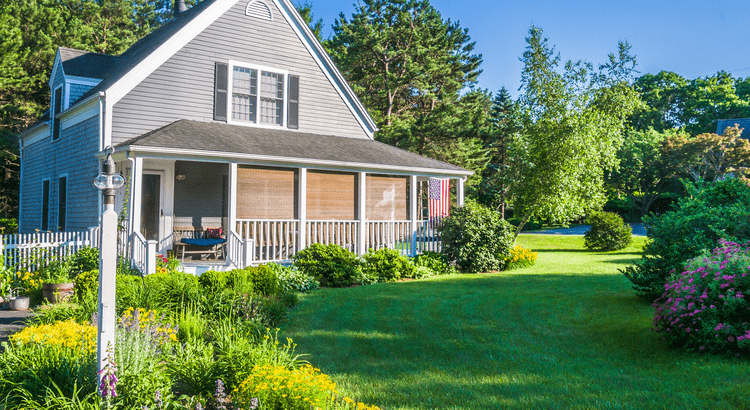

If you’re searching for a home but struggling with high prices or limited inventory, buying a fixer-upper could be a great solution. While these homes may require some TLC, they offer several advantages that make them worth considering. From affordability to customization, here are some of the biggest perks of buying a fixer-upper.

1. Lower Purchase Price

One of the most obvious benefits of buying a fixer-upper is a lower upfront cost compared to move-in-ready homes.

💰 Why it matters:

- Fixer-uppers are often priced below market value, making homeownership more accessible.

- A lower purchase price can result in a smaller mortgage and lower monthly payments.

- You may be able to buy in a better neighborhood than you originally thought possible.

📌 Pro Tip: Work with a real estate agent to find homes that have good bones but need cosmetic updates.

2. Customization to Fit Your Style

When you buy a fixer-upper, you get the opportunity to create a home that perfectly matches your vision.

🎨 Why it matters:

- You can choose your own finishes, from flooring to countertops to paint colors.

- Unlike move-in-ready homes, you won’t be paying extra for upgrades you don’t love.

- Your home will feel uniquely yours instead of settling for someone else’s design choices.

📌 Pro Tip: Prioritize renovations that add value, like kitchen and bathroom updates.

3. Less Competition from Other Buyers

Move-in-ready homes often attract multiple offers, leading to bidding wars. Fixer-uppers typically have less competition, giving you an edge in negotiations.

🏡 Why it matters:

- You may be able to buy at a lower price or negotiate better terms.

- With fewer buyers interested, you’re less likely to lose out in a bidding war.

- Some fixer-uppers stay on the market longer, increasing your negotiating power.

📌 Pro Tip: If a home has been on the market for a while, you might be able to secure a great deal.

4. Potential for Increased Home Value

Investing in the right renovations can increase your home’s value over time.

📈 Why it matters:

- By making smart upgrades, you can build instant equity.

- If you plan to sell in the future, a well-renovated fixer-upper can yield a higher resale price.

- Even minor cosmetic changes can boost the home’s appeal and value.

📌 Pro Tip: Focus on high-ROI renovations, like kitchens, bathrooms, and curb appeal improvements.

5. Access to Renovation Loans & Incentives

Financing a fixer-upper may be easier than you think, thanks to renovation loan programs and grants.

🏦 Why it matters:

- Programs like the FHA 203(k) loan and Fannie Mae’s HomeStyle loan allow you to finance the purchase and renovations in one loan.

- Some local and state programs offer grants or tax incentives for home improvements.

- This allows you to spread out renovation costs instead of paying everything upfront.

📌 Pro Tip: Talk to a mortgage lender about loan options that include renovation funds.

Final Thoughts: Is a Fixer-Upper Right for You?

Buying a fixer-upper isn’t for everyone—it requires patience, vision, and a willingness to take on renovations. However, if you’re looking for affordability, customization, and long-term investment potential, a fixer-upper could be the perfect opportunity to create your dream home.

🔎 Thinking about buying a fixer-upper? Connect with me to find homes with great potential and start your homeownership journey today!

Providing guidance and assisting motivated buyers, sellers, tenants, landlords, and investors in marketing and purchasing property for the right price under the best terms. Determining clients’ needs and financial ability to purchase the best home for them. Call me today and let me help you find a home that can change your life!